Top LLC Formation Services in Maryland

- Form an LLC for $0 + State Fees

- FREE Registered Agent Service for a Year

- Trusted by over 500,000+ Businesses

- 100% Transparency

| |

- Form an LLC for $49 + State Fees

- Fast & Simple LLC Formation

- Launched Over 80,000 Businesses

- 100% Accuracy Guarantee

| |

- Form an LLC for $225 + state fees

- Registered Agent Service included ($125)

- Forming Businesses Since 1998

- 100% Error-Free Guarantee

| |

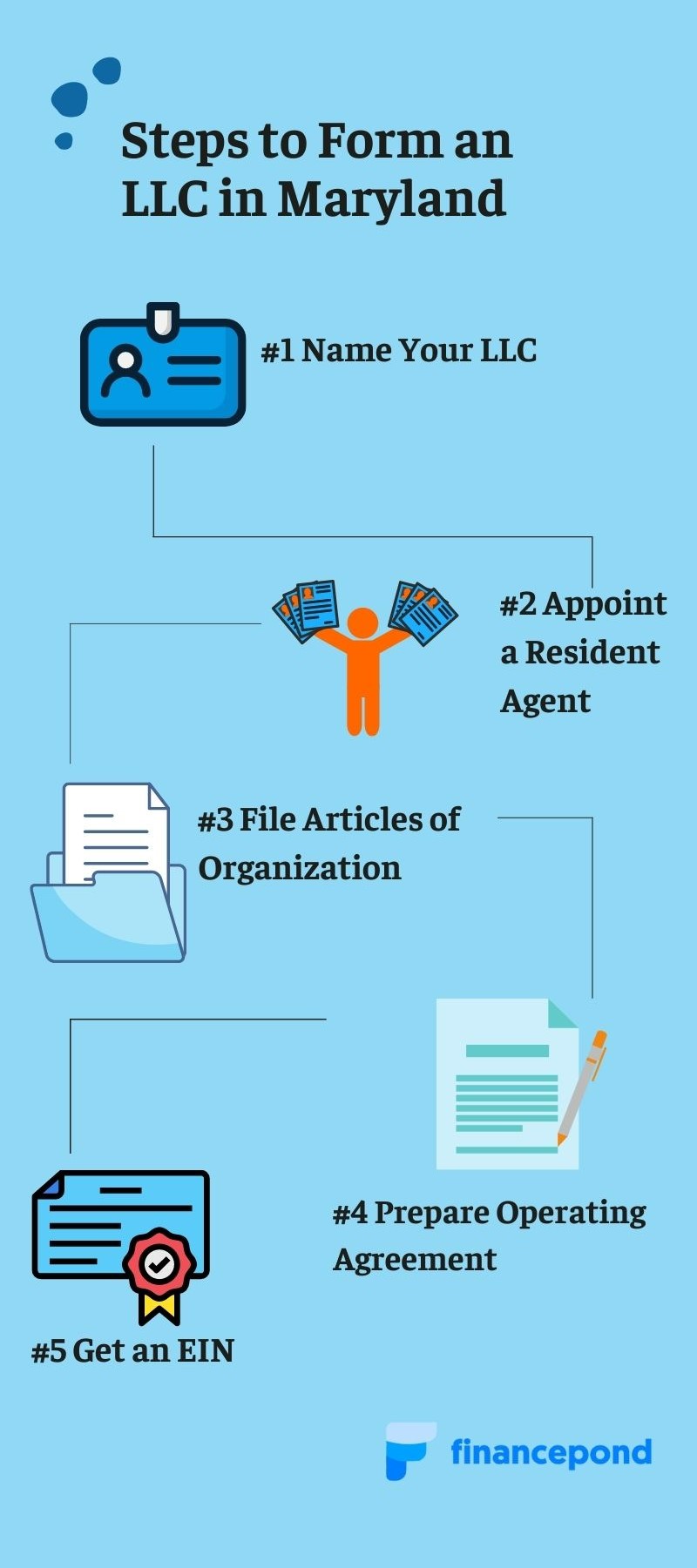

Forming an LLC in Maryland is Easy, Just Follow the Steps

Before we dive into our step-by-step guide, make sure you take a second to read our post on choosing the best state to start your LLC. Maryland is a fantastic state to set up a business but makes sure that is your “home state”. After you read this guide take a second to read that article.

Before we dive into our step-by-step guide, make sure you take a second to read our post on choosing the best state to start your LLC. Maryland is a fantastic state to set up a business but makes sure that is your “home state”. After you read this guide take a second to read that article.

Setting up an LLC in Maryland is a lot less painful than you think. You are required to file your Maryland Articles of Organization in order to properly set up your limited liability company.

The cost to form an LLC in Maryland is $100 which covers the costs of the Articles of Organization. Keep reading and follow the steps below.

#1 Name Your Maryland LLC

The very first step you need to take when establishing your LLC in Maryland is to give it a name. Your business name is the first point of contact with customers so take the time to think of a steller business name!

The very first step you need to take when establishing your LLC in Maryland is to give it a name. Your business name is the first point of contact with customers so take the time to think of a steller business name!

Before you start throwing names into the air, know that there are LLC name guidelines that must be followed.

Maryland LLC Guidelines:

You must add the phrase ‘Limited Liability Company or any of its abbreviations (LC, L.L.C, LLC, L.C) to the end of your business name. For example Baby Showers Limited Liability Company, Baby Showers L.C, Baby Showers L.L.C, etc.

Note that you cannot choose a name or include a term that will make people mistake your limited liability company (LLC) for a state or government agency. For example State, Federal, ‘Department of’, Treasury, etc cannot be included in your LLC name.

There are certain special terms that you can only include in your LLC name if you’re granted legal permission or if certain licensed professionals like lawyers or doctors work in your LLC. These are terms like Associates, Bank, University, etc.

Check LLC Name Availablity:

Once you have a list of top choices for your LLC name, now we need to check the availability.

Availability in Maryland

Take the time to check your LLC names with the Maryland Business Entity Search. You may need to create an account with the Maryland Business Express before you begin your search. Once you are in the clear with your LLC name, check the availability as a domain name.

Availability as a Domain

Every serious business has a website and there’s no reason why you shouldn’t if you don’t already have one. You can check sites like GoDaddy or Bluehost to check if your business name is available as a domain name.

#2 Appoint a Maryland Resident Agent

Once you’ve chosen and reserved your LLC name, you’ll need to appoint a Resident Agent in Maryland. A resident agent is the equivalent of a registered agent, but in Maryland, it’s called a resident agent.

Once you’ve chosen and reserved your LLC name, you’ll need to appoint a Resident Agent in Maryland. A resident agent is the equivalent of a registered agent, but in Maryland, it’s called a resident agent.

What is a Resident Agent (Registered Agent)?

A resident agent, similar to a registered agent, is a person or business entity that receives legal correspondence such as emails, tax forms, legal documents, etc. on behalf of your LLC.

Their job is to help your Maryland LLC stay compliant with state law and regulations. They’re important because they are the government’s first point of contact with your business.

Can Anyone Be a Resident Agent for an LLC?

In order to be a certified Resident Agent in Maryland, you must live in Maryland and have a street address in Maryland. Note that by state law, PO Box addresses are not allowed.

If you’d like, you can nominate yourself, a trusted friend, family member, an individual within your LLC, or a business entity to be your resident agent. If you by chance do not live in Maryland and you do not have a friend or family member that can act as your resident agent, you can use a registered agent service. They usually cost around $100 to $150 a year.

Many LLC incorporation services like ZenBusiness, and Northwest offer great deals on registered agent services. They can also support you throughout your LLC formation so if you get into trouble or simply want to change your registered agent, reach out to the professional filers.

#3 File Your Maryland LLC Articles of Organization

Filing your Articles of Organization is the main requirement in order to form an LLC in Maryland.

Filing your Articles of Organization is the main requirement in order to form an LLC in Maryland.

The state filing costs are $100 and the Articles of Organization must be filed with the State Department of Assessments and Taxation. These forms can be filed online, by mail, or in person. Applications by fax are no longer permitted by the SDAT.

If you’re expanding your LLC operations into Maryland, you will need to set up a foreign LLC. Make sure you understand the difference between a domestic LLC and a foreign LLC after you finish this article.

How to file the Articles of Organization

The Articles of the organization is the document that outlines your business to the government agency. Below are the main questions to expect in the Articles of Organization:

- The name of your Maryland LLC. Be sure to fill your LLC name correctly in the full form approved when you performed your name search.

- What was the purpose of creating your Maryland Business? Simply explain what your LLC does, for example, an automobile shop will put down ‘My LLC sells and repairs automobiles, etc.’

- The physical address of your LLC in Maryland. Please note that PO Boxes are not allowed. If you’d like you can note your resident agent’s address.

- The details of your LLCs resident agent. This will include their full legal name, physical address, and signature.

The Article of Organization is a very straightforward documented and it should take you longer than 20 minutes to fill out.

File Online

Filing online is the fastest way of getting your Articles of Organization approved. The filing costs $100 plus an additional $50 for online submission. You can apply on the Maryland business express site.

Mail-in Articles of Organization

If you decide to mail in your Maryland articles of organization, download the file and send it to the following address:

Department of Assessments and Taxation 301 W. Preston Street Baltimore, MD 21201

The total cost is $100 when mailing in the forms. If you’re in a hurry you can opt for expired filing which is an additional $50.

Walk-in Articles of Organization

If you decide to walk in and hand file the forms be sure to download the form. Both the mailing and walking in addresses are the same:

Department of Assessments and Taxation 301 W. Preston Street Baltimore, MD 21201

What is The Certificate of Organization

Once your Articles of Organization have been approved, the SDAT will send you a Certificate of Organization authorizing your Maryland LLC.

Cost to file Articles of Organization MD

The main cost of setting up your Maryland LLC is $100 which is for your Articles of Organization. Maryland also requires businesses to file an annual report with the Maryland secretary of state which costs $300 yearly.

How Long Does it take to get Maryland LLC Articles of Organization Approved?

The process will be completed within 5- 7 business days online or 4-6 weeks via mail. If you’re in a hurry, file your LLC documents online.

#4 Prepare Your Maryland LLC Operating Agreement

An operating agreement is not a requirement in Maryland, however, we highly recommend taking the time to write one up.

An operating agreement is not a requirement in Maryland, however, we highly recommend taking the time to write one up.

What is a Maryland LLC Operating Agreement?

An operating agreement is a document that outlines the owners of an LLC, how it is going to operate, member-managed LLC or manager-managed LLC, and the duties and role of its members.

Below is a quick checklist of points to explain within your operating agreement:

Ownership –Your Operating Agreement should clearly state who the LLC owners are and how ownership is divided.

Formation and Management – State the day the operating agreement is written and the date the LLC was formed. Also clearly note who LLC members are and how the LLC is managed.

Capital Investment – How much capital investment has been made by each member.

Financials – Explain how profits and losses will be shared in the business.

Membership Structure – How can roles be changed or transferred in case a member leaves the LLC or passes away.

#5 Get an EIN for your Maryland LLC

Once you receive your certificate of organization from the Maryland secretary of state it is time to file for your Employer Identification Number (EIN).

Once you receive your certificate of organization from the Maryland secretary of state it is time to file for your Employer Identification Number (EIN).

What is an EIN?

An Employer Identification Number (EIN) also known as a Federal Employer Identification Number is an identification number issued by the Internal Revenue Service. It’s basically your business’ Social Security Number.

The EIN can be used to process tax payments, annual reports, open an official bank account for the LLC amongst many other things.

Where do I obtain my EIN?

You can get an EIN by applying for a request with the IRS. An EIN is completely free and you have two main options:

- Apply online with the IRS EIN assistant

- Download the EIN form (SS-4) and apply by mail or fax

If you’d like to mail in your EIN request, send it to the address below :

Internal Revenue Service Attn: EIN Operation Cincinnati, OH 45999

You may also fax in your EIN request. Simply fill out the infioraut9n in the document and send it to their fax at (855) 641-6935.

After Forming a Maryland LLC: Keeping your Business Compliant

Once you’ve completed the steps to form an LLC in Maryland, you’ve legally established your business entity! In the section below we are going to go over everything you need to know about business permits, tax requirements, and how to keep your Maryland LLC compliant.

Maryland Licenses and Business Permits

To ensure that everything runs smoothly with the authorities, you must make sure that your business follows federal, state, and local requirements. Depending on your business industry and location, you may need a specific permit or license in order to operate.

Incfile is a professional LLC formation service that offers an in-depth business license research package if you want to double-check, they have everything you need.

There are three governmental levels that you may end up needing a Maryland license or business permit.

Federal Level

Once your LLC in Maryland is all set up, check out the SBA guide and apply for the permits that your LLC needs.

State Level

Depending on the type of business you establish (LLC, Corporation DBA), the industry, and the location, you may need a Maryland state license. Check out Maryland Business Express in order to obtain licenses.

Local Level

There are specific municipalities in the state of Maryland that require permits and licenses for businesses. This depends on your industry, so be sure to check that out with you the borough.

Tax Requirements for your Maryland LLC

You will be required to pay specific taxes for your Maryland LLC based on the way it is managed and the products that are sold.

Maryland Sales Tax – 6%

Based on the products and services that your Maryland LLC is offering, you may or may not be subjected to Maryland sale tax. Physical goods like appliances, computer hardware, property, and vehicles are all subjected to sales tax in Maryland.

If you are selling digital goods such as online movies streamers or an application, you are most likely not required to collect sales tax. Be sure to speak with a professional before you decide whether you collect sales tax or not because there are exceptions to the rule.

If you have found that you are required to collect Maryland sales tax you must request a seller’s permit online through the Maryland Department of Revenue. Make sure that your LLC has an EIN (Step #5) as that is one of the requirements in order to apply.

It is completely free to apply for a Maryland seller’s permit and other is no expiration.

Maryland Employer Taxes

If your business has employees or your plan on hiring employees you’re LLC will need to pay employer taxes. Some of these taxes will go straight to the state of Maryland and some of these taxes will go to the IRS.

You will need to register for Employee Withholding Tax and Unemployment Insurance Tax with the Maryland Department of Labor.

Maryland LLC Taxes

When your LLC starts making money, the IRS, state government, and local government ask for their cut. let’s see how those three legal bodies affect your LLC.

Federal Tax Level

LLCs are hybrid entities that practice a “pass-through” tax methodology. LLC owners must report earnings to the IRS on their personal income tax returns. If you formed a single-member LLC you must file the 1040 Schedule C form and if you are a multimember LLC you are required to file the 1065 partnership form.

Taxes can get complicated and which is why we recommend hiring an accountant for your LLC.

Maryland State Taxes

If you decided to form an LLC, then you’ll be taxed at your personal tax bracket by the state in a progressive manner. The Maryland state taxes range from 2.00% – 5.75% on personal income.

County Taxes

Maryland is one of the few states in which local governments tax personal income. There are over 20 counts in Maryland and they charge anywhere from 2.25% – 3.20% on personal income. Make sure to reach out to your local accountant before filing.

Maryland LLC Annual Report

If you own a business in Maryland you must file an annual report with Maryland’s Department of Assessments and Taxation. There may be a few other reports that you need to file as well, be sure to check in with your lawyer.

What is the Maryland Annual Report?

A Maryland annual report provides a broad overview of the business operations that an LLC conducted in the previous year.

Also known as a personal property return report, the Maryland Annual report includes financial information which gives a clear understanding of how the company performed throughout the previous year.

How to File a Maryland Annual Report

Each year your Maryland business must file an annual report and send it to the Maryland State Department of Assessments and Taxation.

The cost is $300 annually and the deadline is April 15th.

You may file the report online or send it in the mail.

File Online

If you file your annual report online, send it to the Maryland Business Express.

Mail-in Annual Report

Print out the form and send it to the following address:

Department of Assessments and Taxation, Taxpayer Services Division, P.O. Box 17052 Baltimore, MD 21297

Avoid Late Fees

The State of Maryland charges a late filing fee of 10% of your personal property value. This is a rabbit hole that is not worth going down as fees can really stack up and failure to file can result in your business shutting down.

Maryland LLC FAQ

How to Apply for an LLC in Maryland?

To apply for an LLC in Maryland you’ll need to file Articles of Organization with the Maryland Department of Assessments and Taxation which costs $100 for the filing fee.

How to File a DBA in Maryland?

In order to receive a DBA in Maryland, you must send a Trade Name Application to the Maryland Department of Assessments and Taxation. Filing for a DBA is accessible on Maryland’s Business Express website and costs $25 or $75 for expired service.

How Much Does it Cost to Register a Business in Maryland?

To legally form a business in Maryland you must file the Articles of Organization which costs $100.

How Long Does it Take for an LLC to be Approved in Maryland?

It generally takes 4-6 weeks for LLC paperwork to be approved by mail. You can request expedited processing time which costs an additional $50. If you file online it takes 5-7 business days for your business to be approved.

What is an SDAT number in Maryland?

An SDAT number is a unique identification number given to your business by the Maryland Department of Assessments and Taxation. Your SDAT number will begin with a letter “D”, “F”,”L”, “T”, “W”, or “Z”.

How do I get a Maryland SDAT Identification Number?

A Maryland SDAT identification number is very different from your EIN which is an identification number handed out by the IRS when your start an LLC.

Once you’ve registered your LLC with the Maryland Department of Assessments and Taxation, they will send you your SDAT Identification Number. This number acts as Maryland’s unique identification number for your LLC and starts with the letter “D”, “F”, “L”, “T”, “W”, or “Z”.

How to Get a Business License in Maryland?

If your limited liability company (LLC) needs a business license, head over to the Maryland OneStop Portal. Business licenses and permits are required for most businesses.

You may apply for licenses and permits such as mechanics, real estate, home inspection registrations, insurance, and many other licenses.

Sources:

- (IRS) Maryland

- (Business Express) Register Maryland Business

- (Maryland Gov) Forms and Applications

Before we dive into our step-by-step guide, make sure you take a second to read our post on choosing the

Before we dive into our step-by-step guide, make sure you take a second to read our post on choosing the  The very first step you need to take when establishing your LLC in Maryland is to give it a name. Your business name is the first point of contact with customers so take the time to think of a steller business name!

The very first step you need to take when establishing your LLC in Maryland is to give it a name. Your business name is the first point of contact with customers so take the time to think of a steller business name! Once you’ve chosen and reserved your LLC name, you’ll need to appoint a Resident Agent in Maryland. A resident agent is the equivalent of a registered agent, but in Maryland, it’s called a resident agent.

Once you’ve chosen and reserved your LLC name, you’ll need to appoint a Resident Agent in Maryland. A resident agent is the equivalent of a registered agent, but in Maryland, it’s called a resident agent. Filing your Articles of Organization is the main requirement in order to form an LLC in Maryland.

Filing your Articles of Organization is the main requirement in order to form an LLC in Maryland. An operating agreement is not a requirement in Maryland, however, we highly recommend taking the time to write one up.

An operating agreement is not a requirement in Maryland, however, we highly recommend taking the time to write one up. Once you receive your certificate of organization from the Maryland secretary of state it is time to file for your Employer Identification Number (EIN).

Once you receive your certificate of organization from the Maryland secretary of state it is time to file for your Employer Identification Number (EIN).