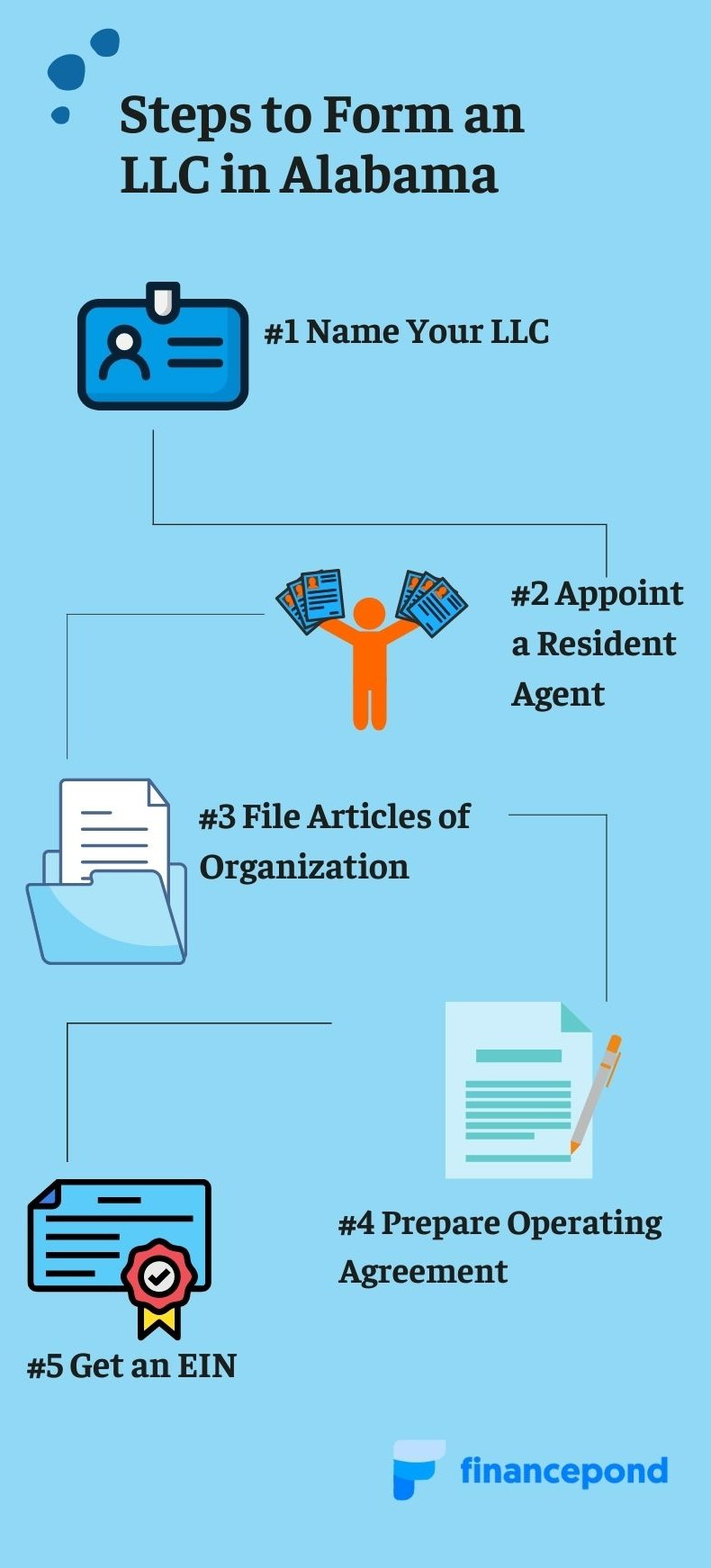

Starting an LLC in Alabama is Easy!

Have you asked yourself if Alabama is the best state to set up your LLC? Alabama is the recommended state to form your business if it is your “home state” (This is known as a domestic limited liability company). You may also set up a business as a foreign LLC, but make sure to take a second to scan through our articles to make sure you’re setting yourself up properly.

Have you asked yourself if Alabama is the best state to set up your LLC? Alabama is the recommended state to form your business if it is your “home state” (This is known as a domestic limited liability company). You may also set up a business as a foreign LLC, but make sure to take a second to scan through our articles to make sure you’re setting yourself up properly.

Forming an LLC in Alabam is quite easy, in fact, all you need to do is file your Certificate of Formation with the Alabama Secretary of State. The Certificate of formation is the main legal document required to set up your LLC.

You may send the application to the Alabama Secretary of State online or via mail and the cost to file the form is $200. Below we are going to guide you throughout the entire process of establishing and keeping your limited liability company compliant.

#1 Name Your Alabama LLC

The first step in forming your LLC in Alabama is thinking of a company name. Before you get attached to your company name, take a second to ensure that you comply with the Alabama name requirements below.

The first step in forming your LLC in Alabama is thinking of a company name. Before you get attached to your company name, take a second to ensure that you comply with the Alabama name requirements below.

Alabama LLC Name Guidelines

- Your name must mark that your company is an LLC by including, “LLC”, “limited liability company”, “L.L.C” or other.

- Your name can’t contain abbreviations, words, or phrases that indicate it is organized for a purpose not mentioned in the Certificate of Formation (more on that below). For example, you can’t call your LLC a “practice” if you aren’t practicing a professional practice or something of that nature.

- You may not include words or phrases that may mislead your business for a government agency. Therefore you cannot include phrases or like State Department, CIA, or anything similar in your LLC name.

Check LLC Name Availablity in Alabama:

Once you have a few good potential LLC names, search the Alabama Secretary of State’s database of business names to see if the business name of your liking is available.

Alabama Name Reservation

If you decide to file your certificate of formation by mail, then you’ll need to also file a name reservation request that can be downloaded. There is a processing charge of $25 per name reservation.

Is the LLC Name Available as a Domain (URL)?

The last thing to ensure that you’ve chosen the proper LLC name is to check and see that the domain name is available. This way you can build your online presence and start getting your brand out there.

- GoDaddy or Bluehost are great platforms to check and see if your domain is available.

#2 Appoint an Alabama Registered Agent

If you would like to form an LLC in Alabama, you must appoint an Alabama Registered Agent.

If you would like to form an LLC in Alabama, you must appoint an Alabama Registered Agent.

What is an Alabama Registered Agent?

A Registered Agent is an individual or company that takes on the legal responsibility to receive legal notices for your LLC and maintain compliance with the state. Your registered agent asks as a liaison between the government officials and your business.

In the event that your business is called for summoning at the court, your registered agent will be required to respond on your behalf.

There are many services like Incfile, ZenBusiness, and Northwest Registered Agents that offer registered agent services for your business. Check them out after the article.

Can anyone be a Registered Agent in Alabama?

In order to act as a registered agent, you must be a resident of the state, over 18, and have an address in the state.

You, a family member, or a friend may act as a registered agent if the requirements above are met. If you want to keep your identity unknown or simply want a professional LLC formation service to take care of it, hire a registered agent service.

The cost ranges from $100-$149 a year and LLC services like Bizfilings, Incfile, and Legalzoom can take care of the entire process.

#3 File Your Alabama LLC Certificate of Formation

The single document that you need in order to form your Alabama LLC is the Certificate of Formation. In most states, this document is called “Articles of Organization” so if you haven’t of that term no reason to worry as they’re the same thing.

The single document that you need in order to form your Alabama LLC is the Certificate of Formation. In most states, this document is called “Articles of Organization” so if you haven’t of that term no reason to worry as they’re the same thing.

Your Alabama Certificate of Formation will tell the state government the following information:

- The purpose of your LLC (i.e. what kind of business it is)

- The names and addresses of the primary manager for the company

- The signatures of managers and officers for the LLC

- The lifespan of the LLC – you’ll be able to choose that it will exist in perpetuity or only for a certain amount of time

The Certificate of Formation informs the state government of the type of LLC you are creating and the reason for its existence such as:

Tax Classification Choices

Your Certificate of Formation will require you to choose your tax classification for your LLC. Three choices are available:

- Disregarded entity, which is appropriate if you are the only member of your LLC

- Partnership, which is a good classification for a small LLC but with more than one member

- S or C Corporations, which are classifications for bigger LLCs that are nonetheless not full corporations

Your choice of tax classification is very important and will affect which tax breaks you can benefit from. Single-member LLCs are classified as disregarded entities and are not required to report their profits or losses separate from those of their owners/managers.

The resulting tax process is much simpler compared to the processes required for larger LLCs with separately reported profits and losses.

Alabama LLC Management Structure

You’ll also have to outline your management structure in your Certificate of Formation. Your LLC can be either manager-managed or member-managed.

Manager-managed LLCs are suitable structures for larger companies. With this structure, only the managers of your LLC will vote on big decisions, leaving any junior or entry-level members out. A member-managed LLC is a better structure for a smaller company, as every member in the LLC gets to vote on decisions.

Think carefully about the structure you choose, as it will affect how rapidly your organization can make decisions or adjustments in the future.

How to File a Certificate of Formation in Alabama Online

You can file your Alabama Certificate of Formation either online or by mail. In either case, you’ll need to file a $200 fee with the Secretary of State.

To file your Certificate of Formation online, follow the below process:

- Visit the Alabama Secretary of State site

- Download the Alabama Certificate of Formation form and fill it out as a PDF

- Enter the name of your LLC

- Then enter the form preparer’s information. This is you – the form requires your name and full address

- Enter the name of the registered agent and their home address and mailing address

- You can skip the section about “special entity selection”, as it only applies to Series or Professional LLCs

- Mark the effective filing date. This tells the Alabama Secretary of State’s office when you want your LLC to “start” in an official sense. You can only delay the effective date of your LLC by up to 90 days after signing the Certificate of Formation

- Sign and date the Certificate of Formation

- Be sure to make two copies of your Certificate of Formation, then pay the applicable fees on the government portal. You can pay with a credit card in all cases, and some counties let you send checks or money orders

Filing by Mail

If you’d like to file your Certificate of Formation by mail, download the above Certificate of Formation form and print it out. Then, after filling the form, mail it to the following address:

Alabama Secretary of State – Business Services Division 770 Washington Ave., Suite 580Montgomery, AL 36104

You can pay the fee by check to the Alabama Secretary of State Business Services Division.

Changes to Alabama LLCs Beginning in 2021

Changes to Alabama LLCs Beginning in 2021

Previously, Alabama LLCs had to file their Certificates of Formation with their country’s Probate Judge and the Secretary of State. This involved paying two fees, sending two copies of documents in the mail, and much more complexity overall (as each county had its own rules and fees, etc.).

As of early 2021, LLCs only file their Certificates of Formation with the Secretary of State and pay a single $200 fee. Act 2020-73, which took effect Jan 1, 2021, also removed the probate judge requirements and allowed LLCs to file LLC forms online in the future.

Forming an LLC in Alabama is much much easier than it was prior to 2021 so it’s a great time to start a company today!

#4 Prepare Your LLC Operating Agreement in Alabama

Preparing an operating agreement is the next objective on the checklist of forming an LLC in Alabama. An Operating Agreement is not required by law in order to register an LLC, but it’s a really good idea to draw one up.

Preparing an operating agreement is the next objective on the checklist of forming an LLC in Alabama. An Operating Agreement is not required by law in order to register an LLC, but it’s a really good idea to draw one up.

What is an LLC Operating Agreement?

An Operating Agreement serves as a structural and guiding document for your LLC, dictating all of the rights and responsibilities for both members and managers. For example, the Operating Agreement will explain when discussions about salaries are held, what salary levels will be for members and managers, and more.

Operating Agreements are also important because they:

- Explain in detail how your LLC will be managed

- Ensure that you and other managers won’t be held personally liable for LLC activities, as the Operating Agreement distinguishes your LLC as a separate business entity

Imagine a scenario where one of the managers in your LLC disagrees with another about hiring family members. If your Operating Agreement has rules and restrictions against who can hire new members into the LLC, you can look to this document to resolve the disagreement before things escalate.

Naturally, it can be a bit of a headache to make an airtight Operating Agreement. In that case, you might consider hiring a professional LLC formation service, which can make sure you cover all your bases or simply find a free operating agreement outline online.

#5 Get an EIN for your Alabama LLC

Once you receive approval of your LLC from the Alabama secretary of state, you can now get your Employer Identification Number (EIN).

Once you receive approval of your LLC from the Alabama secretary of state, you can now get your Employer Identification Number (EIN).

Note: Do not get your Employer Identification Number before your LLC is approved as the identification number will be connected to you as a sole proprietor.

What is an Employer Identification Number (EIN)?

An EIN is a nine-digit number that acts as an identifying string for your business, sort of like a Social Security number. You need an EIN in order to hire employees, open a dedicated business bank account, and file federal and state taxes for your business separately from your own income.

How Do I Get EIN for an Alabama LLC?

You can obtain your EIN from the IRS and it is completely free. There are two main ways to get your EIN from the IRS:

- Apply online with the IRS EIN assistant

- Download the EIN form (SS-4) and apply by mail or fax

If you decide to mail in your EIN the address is :

Internal Revenue Service Attn: EIN Operation Cincinnati, OH 45999

If you decide you’d like to fax in the EIN request fill out the form and fax the information to (855) 641-6935.

After Forming an Alabama LLC: Keeping your Business Compliant

Once you’ve completed steps 1 through 5 to form an LLC, you’ve legally created your company in Alabama!

If you have not finished the steps above, this section isn’t relevant just yet. Below we are going to cover the main things that you need to know as a business owner in relation to LLC licenses, Tax requirements and how to overall keep your Alabama LLC company with the Alabama secretary of state.

LLC Licenses and Business Permits in Alabama

Depending on the nature of your business you may or may not need a license/business permit to operate. There are three levels that you must check and verify that you have the proper licensing which are the federal, state, and local requirements.

Most businesses need a combination of licenses from the federal and state-level agencies.

If you need a hand, Incfile is an LLC formation service that provides a business license research package. They scan the requirements based on the nature of your business and explain exactly what you need. If you want to double-check, they can be a big help.

Federal Level

If your business has anything to do with agriculture, firearms, alcoholic beverages and more you’ll need to get a federal license because your business is regulated at the federal level.

Check out the SBA guide to apply and discover which permits and/or license that your LLC needs.

State Level

Depending on the business structure that you create (LLC, Corporation DBA) and the nature of your business, you may be required to obtain specific licenses and permits in Alabama. Head over to the Alabama Department of Revenue to not only file your taxes but to qualify for licenses for your business.

Local Level

There are 67 counties in Alabama and based on the business industry and county that your LLC resides in you may or may not need a license or a permit. Once you’ve decided on the location, check out the Association of County Commissions of Alabama. There you will find all of the 67 counties and their requirements.

Alabama LLC Business Privilege License

If you have an LLC in Alabama or are doing business via DBA or a corporation, you’ll need to get a business privilege license. Licenses can be obtained by your local county Probate Judge and must be purchased in every county that you do business in.

The cost of a Business Privilege License varies by county.

Alabama LLC Annual Report and Business Privilege Tax

In Alabama, there are two reports that need filing within the first year of forming a limited liability company. A one-time Initial Business Privilege Tax called Form BPT -IN followed but an annual Business Privilege Tax Return.

Alabama Initial Business Privilege Tax

This is a one-time form that must be filed 2.5 months after your LLC is formed. This form is called BPT-IN and it must be sent to the Alabama Department of Revenue.

- Cost of the report: $100

- File date: 2.5 months after you form your LLC

- Name of the form: Form BPT-IN

- Ongoing: No

Alabama Business Privilege Tax Return

This annual tax report must be filed with the Alabama Department of Revenue and not with the secretary of state. Basically, all businesses in the state of Alabama are required to pay a tax for doing business in Alabama.

There’s really no way to get around this Tax and is it important that you file this yourself or get an accountant for your LLC to do it for you.

The Tax that is required to pay is based on your taxable income and the bare minimum Tax is $100.

- Cost of the report: $100 minimum

- Due by: April 15th

- Name of the form: Form PPT

- Ongoing: April 15th of every year

Download PPT form here

Tax Requirements for your Alabama LLC

There are a few potential taxes that you may need to pay to the federal and state authorities such as Income Tax, Franchise Tax, Corporate Tax, Sales Tax Employer Tax, and more. These taxes are based on the way your LLC is managed and the products that you sell. There are

We are going to go over the two main taxes which are most likely going to affect your business which is sales tax and Employer tax.

Alabama Sales Tax – 4%

First off, we need to understand if you are required to pay Alabama sales tax or not.

Specific goods and services are subjected to sale tax like clothing, gardening appliances, vehicles, and digital goods such as online films or downloaded music. Alabama requires business owners to collect sales tax, and for that, you’ll need to register for a seller’s permit.

For more information on sales tax, take a look at the Alabama Department of Revenue State Tax guide

Alabama Employer Tax

If your LLC has employees or you plan on hiring in Alabama, you need to register for Unemployment Insurance Tax.

This is a small tax paid to the IRS annually. You will also need to apply for Employee Withholding Tax which sets aside a small amount of money from your employee’s paycheck and pays it to the government. You can apply on the Alabama Department of Revenue site.

Important State of Alabama Links

Below are important state links that you need in order to create a business in Alabama and obtain licenses.

Alabama State Registration

Alabama Department of Revenue: Business

Alabama Department of Revenue: Sales Tax

Alabama Department of Revenue: Business Tax Online Registration System

Alabama Business Licenses

Alabama Department of Revenue: Business & License Tax

Local County Requirements

Association of County Commissions of Alabama: County Links

Alabama Secretary of State: County Official Lookup

Alabama LLC FAQs

How to Start an LLC in Alabama?

Starting a limited liability company in Alabama is simple, just follow the steps below.

- Name your LLC

- Appoint a Registered Agent

- File the Certificate of Formation

- Prepare an Operating Agreement

- Obtain your EIN

Make sure you take the time to read and understand the in-depth steps above. That will help save a ton of time and headaches down the road.

How Long Does it Take to Get an Alabama LLC?

Once you file your certificate of formation, it usually takes 5-10 business days to receive an approved LLC from the Secretary of State. Then it may take a day or two for EIN approval.

How to Start a Nonprofit in Alabama

Starting a nonprofit in Alabama is very similar to forming a limited liability company (LLC).

- Name your Alabama nonprofit

- Get a name reservation with the Alabama Secretary of State

- Get incorporators and directors on board your nonprofit

- Hire a registered agent service

- File Articles of Incorporation for your nonprofit

- Get your Federal Tax ID

Once you’ve completed the steps above, your nonprofit will be legally operational. Moving forward, make sure you obtain the proper permits and licenses before you begin operations.

How to Fill out Alabama A-4 Form

In order to fill out the Alabama A-4 form, also known as Employee’s Withholding Tax Exemption Certificate, you must have the following information:

- Employees full name

- Social Security Number

- Home Address

Once your personal information is filled in, there are 6 personal questions that must be answered in order to claim your withholding exemptions.

Note: There are many lines to be filed on the A-4 form, only complete what applies to your specific situation.

Note: There are many lines to be filed on the A-4 form, only complete what applies to your specific situation.

How Much Does an LLC Cost in Alabama

The cost to form an LLC in the state of Alabama is $200 by mail and $208 online. The fee is paid to the Alabama Secretary of State.

How to Dissolve an LLC in Alabama

If you’re looking to dissolve your Alabama limited liability company (LLC) follow the simple steps below:

- Act according to your Operating Agreement

- Close down your Business Tax Accounts

- File Articles of Dissolution

Filing Articles of Dissolution is the main and most important step in legally dissolving an Alabama registered business, but be sure to follow the guidelines in the Operating Agreement.

How Do I Get an EIN Number in Alabama

An EIN or a FEIN (Federal Identification Number) can be obtained on the IRS website or by simply calling 1-800-829-1040.

Have you asked yourself if Alabama is the

Have you asked yourself if Alabama is the  The first step in forming your LLC in Alabama is thinking of a company name. Before you get attached to your company name, take a second to ensure that you comply with the Alabama name requirements below.

The first step in forming your LLC in Alabama is thinking of a company name. Before you get attached to your company name, take a second to ensure that you comply with the Alabama name requirements below. If you would like to form an LLC in Alabama, you must appoint an Alabama Registered Agent.

If you would like to form an LLC in Alabama, you must appoint an Alabama Registered Agent. The single document that you need in order to form your Alabama LLC is the Certificate of Formation. In most states, this document is called “Articles of Organization” so if you haven’t of that term no reason to worry as they’re the same thing.

The single document that you need in order to form your Alabama LLC is the Certificate of Formation. In most states, this document is called “Articles of Organization” so if you haven’t of that term no reason to worry as they’re the same thing. Changes to Alabama LLCs Beginning in 2021

Changes to Alabama LLCs Beginning in 2021 Preparing an operating agreement is the next objective on the checklist of forming an LLC in Alabama. An Operating Agreement is not required by law in order to register an LLC, but it’s a really good idea to draw one up.

Preparing an operating agreement is the next objective on the checklist of forming an LLC in Alabama. An Operating Agreement is not required by law in order to register an LLC, but it’s a really good idea to draw one up. Once you receive approval of your LLC from the Alabama secretary of state, you can now

Once you receive approval of your LLC from the Alabama secretary of state, you can now  Note: There are many lines to be filed on the A-4 form, only complete what applies to your specific situation.

Note: There are many lines to be filed on the A-4 form, only complete what applies to your specific situation.